Humphrey Yang

US

en

Followers

3.4mAverage Views

14.7kEngagement Rate

5.2%@humphreytalks is a finance guru simplifying complex concepts for Gen Z and millennials. He breaks down topics like investing, budgeting, and credit, making them accessible with engaging visuals and relatable humor. His goal: financial literacy for all.

Performance

Related Profiles

3 Things I Would Never Do With My Money... Do you agree? 1️⃣ I would never lend it to friends/family: this can get messy, awkward, and strain your relationships. Instead, I like to just offer a small % of what they’re asking for and take the L. So if your friend is asking for $500? Offer them $50 and call it a day. Yes, it still sucks to part ways with your money, but at least you are helping your friend in need. They may not love it, but it’s better than completely shutting them out IMO. 2️⃣ Saving money in a big bank. These big banks never pay any interest on their savings or checking accounts. Just move funds you dont need to touch immediately to a high yield account. 3️⃣ I would never spend it on something that depreciates rapidly without adding real value to my life. I'm talking about things like expensive cars that lose 20% of their value the moment you drive them off the lot, designer items bought just for status, or the latest gadgets that'll be outdated in six months. Before making any major purchase, I always ask myself: Will this genuinely improve my life or help me earn more money? Humphrey

51.4k

4.61%

When the stock market is at all time highs, don’t be discouraged investing. 1️⃣ If you missed just 10 of the best days in the market in the past 30 YEARS, you could erase your gains by 54%. 2️⃣ Missing 20 days will cost you 73% of your total gains, and missing 30 days will result in 83% less. This means that the old adage, time in the market beats timing the market - is undecidedly true. So… when are the best days? When do they happen? They actually happen when the market is down! 50% of the time they happen when investor confidence is low and the market is trading down 20% from all time highs. I hope this encourages you to stay invested. Humphrey

266.8k

3.76%

What’s something you’ve bought that’s been totally worth it? Let me know in comments!

136.7k

3.67%

The Roth IRA is one of the best accounts to become a millionaire. Here’s what I think:

1️⃣ Make sure your high interest debt is taken care of, otherwise it makes more financial sense to just pay that off first since its rare that you will make more investing in terms of a return % 2️⃣ The Roth IRA has income limits. If you make more than $150k individually or $236k filing jointly, you may not be able to contribute the full amount. If you make more than that, you can do whats called a Backdoor Roth IRA - which I can make a different video for. 3️⃣ It is one of the best accounts since all your profits grow tax free. 4️⃣ You can open one up at any brokerage, and it honestly might just take 5 minutes to set up. It’s so worth it though. Let me know if you have questions! Humphrey

79.1k

5.06%

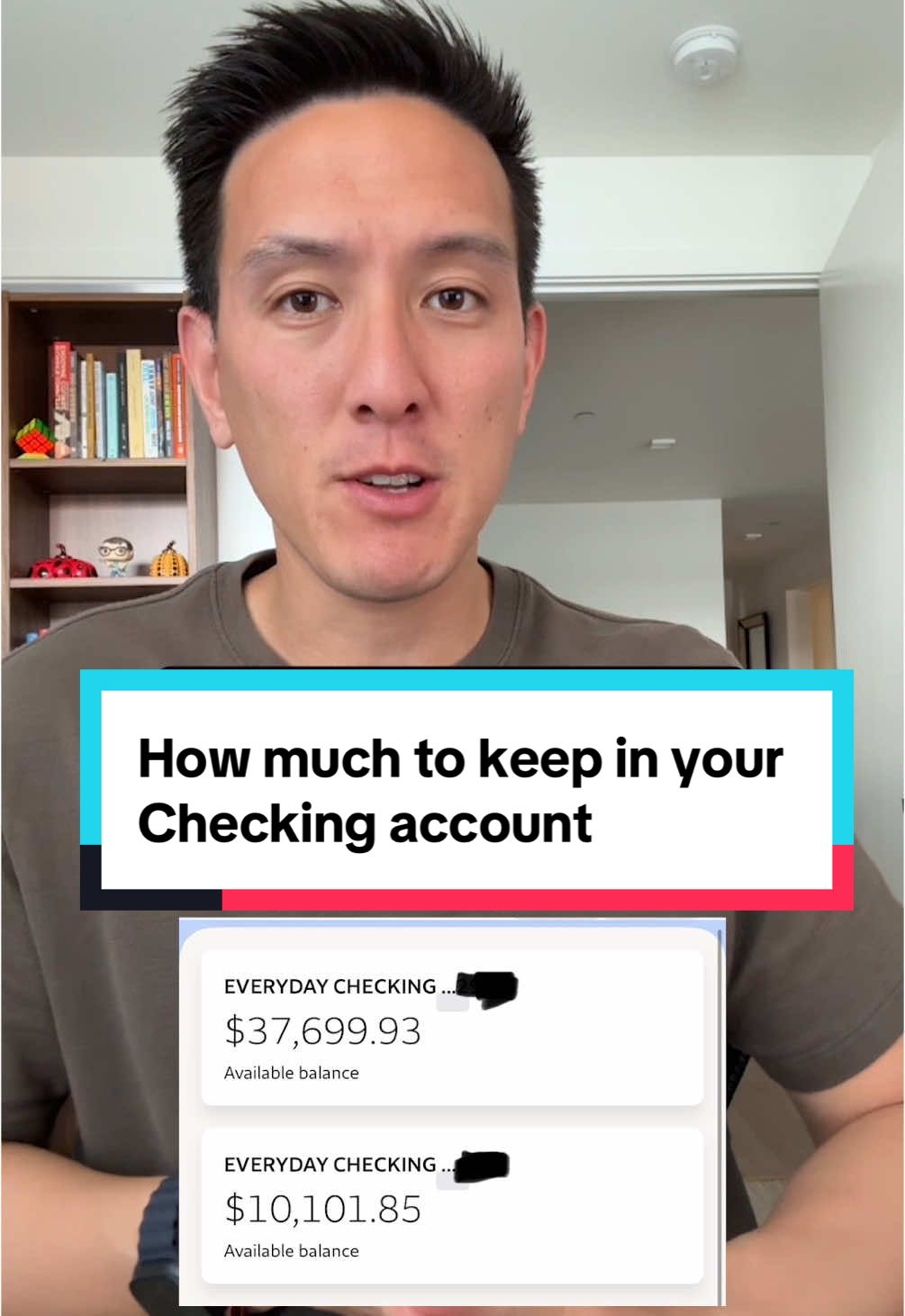

How much money do you keep in your checking account? Here’s the way I like to think about it: 1️⃣ Add up all your monthly bills - rent, utilities, car payments, etc. Remember that number. 2️⃣ Ballpark/estimate how much you spend for discretionary expenses on a monthly basis, this includes purchases like eating out, coffee, shopping, entertainment. 3️⃣ Add those numbers from #1 and #2 together. Let’s pretend that number is $3000. 4️⃣ Add a 10-20% buffer. So keep $3000 + $300 = $3300, or $3000 + $600 = $3600 in your checking account. Humphrey

681.8k

2.81%

3 Financial Milestones for those Making $100K / Year!

80.6k

2.62%

The biggest homeowner mistake I see? Shopping around for everything EXCEPT insurance. You'll compare mortgage rates for weeks but just accept whatever insurance your lender recommends. Customers who switched to GEICO saved 20%+ and got to choose their own coverage! @GEICO #GEICOpartner

48.5k

0.74%

You could be closer to homeownership than you think. Introducing Buy a Home by @bilt. See real homes for an all-in monthly cost. Plus earn points when you close. #biltpartner

117.7k

0.78%

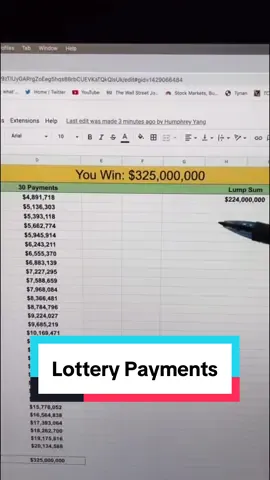

Lottery Payments: Lump Sum vs Payments. Which one are you choosing?

308.8k

3.04%

Chase Sapphire Reserve’s New $795 Annual Fee: is it worth it? What I’m doing. What are your thoughts?? Lmk below ⬇️

87.8k

3.76%

I was dreading car shopping season until I found my secret weapon 🎯 Watch how @Claude by Anthropic transforms the car research game (and any research for that matter). I was able to get market analysis, monthly payment calculations, questions to ask the dealer, and have Claude help me reveal any hidden costs I never considered. #ClaudePartner

51.3k

1.33%

Stitch with @kellieturner_ Making videos can change your life, but you’ll still have to work 😅 Here are some of my top tips to being a creator:

1. Choose a niche that you have some expertise in or that you like to talk about. Then create content around pillars of content. For every 5 videos, perhaps you make 1 How To Video, 1 Tutorial, 1 Vlog, 1 Day in Your Life, 1 Review video - then see which format performs the best and double down on what works. 2. Stay consistent. Honestly the only reason I’m still here is because I still post… if you can stay consistent you can ride out the waves of volatility that is social media. 3. Don’t care about what others think. It’s going to be cringe in the beginning but who cares? We’re all gonna die anyway 4. If you don’t enjoy it — quit. You must be able to enjoy the process. Don’t be results oriented 5. The “algorithm” doesn’t hate you. The algorithm is just PEOPLE, and all the platforms care about is watch time. Focus on making videos with engaging hooks (first 3-5 seconds). Humphrey

110.7k

3.63%

The difference between 14 karat, 18 karat and 22 karat gold. Explained! Follow for more :)

718.6k

5.54%

Technology

Fastest Growing