Call to Leap

FR

en

Followers

1.5mAverage Views

7.5kEngagement Rate

3.5%@calltoleap, a finance guru, simplifies complex investing concepts for Gen Z. He breaks down stocks, crypto, and personal finance through engaging, relatable videos. With a focus on long-term wealth building, he inspires his audience to take control of their financial future.

Performance

Related Profiles

What I’m Investing To Get To $500K! 💰 I will share the stocks and ETFs I’m planning on buying, plus the ones I’m currently holding right now! 🎥📈 Comment “BLOSSOM” and I’ll send you the app to see this entire transparent list of everything that I’m investing in. Yes, this is FREE!" -Steve If you’re ready to start investing this year, don’t miss my next Beginner’s Investing Masterclass! Sign up now — link in bio! Follow @calltoleap Follow @calltoleap for investing videos Follow me @calltoleap to start your journey toward financial freedom! #InvestingJourney #StocksAndETFs #InvestSmart #500KGoal #FinancialFreedom

50.9k

3.81%

Comment “INVEST” and I’ll send you an invite to my beginners investing master class. And yes it's completely FREE! Keep watching to learn the 3 things you can do to set your kids up on the path to becoming millionaires! 💰👶 1. When your kids are born, immediately put $2500 into their investing account 2. Put $50 into this account every week, investing in ETFs that track the S&P, like SPY, VOO, or IVV. 3. For every major holiday, put $200 into their investing account If you stay consistent, they will have around $160k by the time they turn 18 🙂 Remember, investing early is crucial to financial independence later in life, so teach them young! -Steve If you’re ready to start investing this year, don’t miss my next Beginner’s Investing Masterclass! Sign up now — link in bio! Follow @calltoleap Follow @calltoleap for investing videos Follow me @calltoleap to start your journey toward financial freedom!

25.9k

3.47%

Do you know how much of your paycheck you should invest each month? In this video, I’ll break it down using the 80/20 rule so you can start building real wealth. Comment “money” and I’ll send you my Money Cheat Sheet! - Steve If you’re ready to start investing this year, don’t miss my next Beginner’s Investing Masterclass! Sign up now — link in bio! Follow @calltoleap Follow @calltoleap for investing videos Follow me @calltoleap to start your journey toward financial freedom! #QuitThe9to5 #FinancialFreedom #Mid20sMoneyMoves #CallToLeap #CareerAndWealth

38.9k

2.88%

Comment INVEST or tag your friend if you want to learn how to invest at my next Beginners Investing Master Class 🙂 Want to become a millionaire in your 20s or 30s? Start with these steps today: 1. Open a Roth IRA account. 2. Set aside $19.17 every day to invest. 3. Link your checking account and set up automatic deposits for convenience. 4. Once the money settles, invest in low-cost S&P 500 index funds. By the time you turn 60, you could have around $1M, with about $900k of it coming from compound interest. The best part? 100% of that money is tax-free because it’s in a Roth IRA! The key is to start today so your money has plenty of time to grow through compounding. 🙂 -Steve If you’re ready to start investing this year, don’t miss my next Beginner’s Investing Masterclass! Sign up now — link in bio! Follow @calltoleap Follow @calltoleap for investing videos Follow me @calltoleap to start your journey toward financial freedom!

20.1k

3.74%

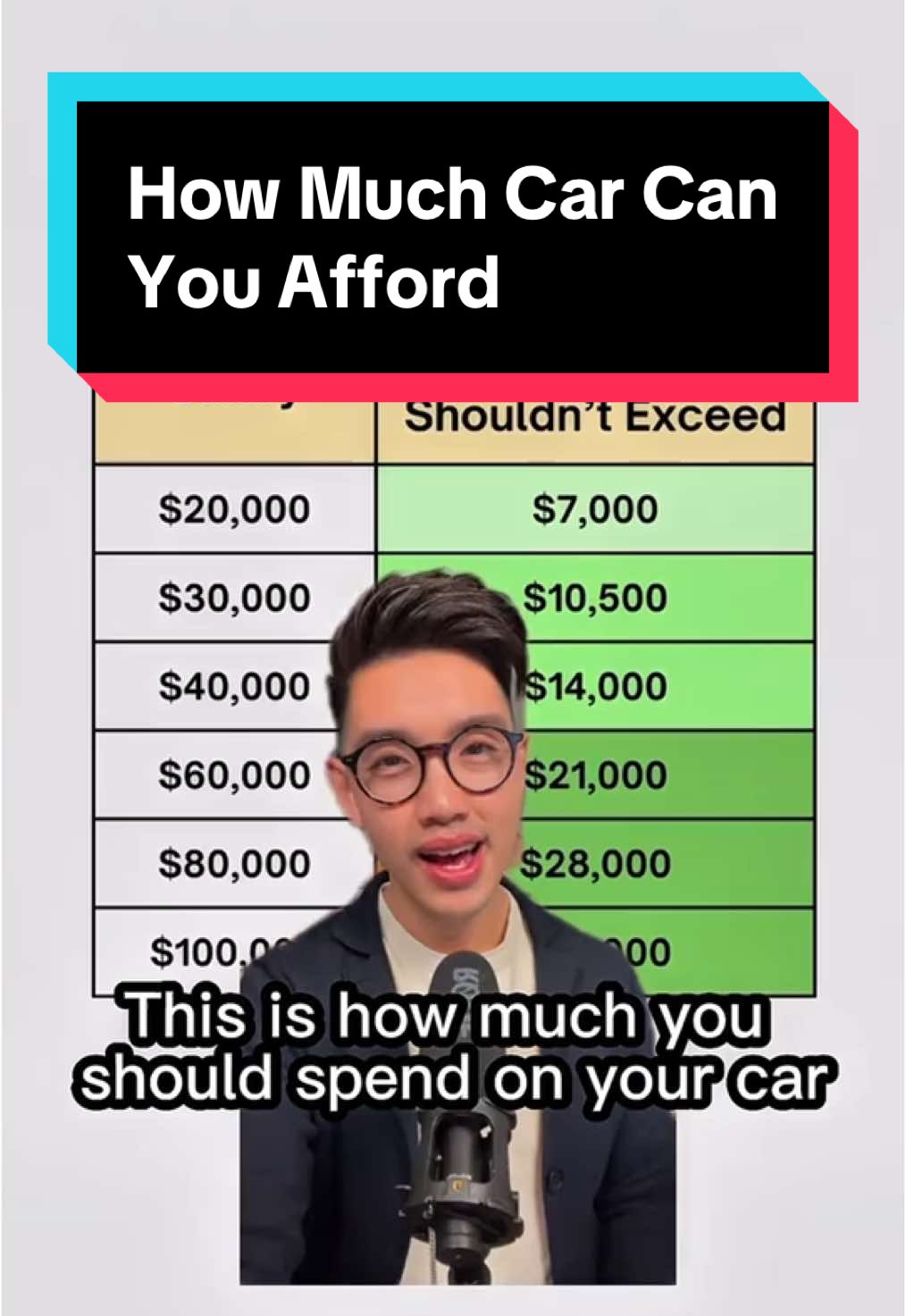

Wondering how much you should spend on your car based on your salary — according to the 35% rule? I'll tell you how on this video! 🚗💸 Comment MONEY and I'll send you my free checklist and calculator so you can put in your own number! - Steve If you’re ready to start investing this year, don’t miss my next Beginner’s Investing Masterclass! Sign up now — link in bio! Follow @calltoleap Follow @calltoleap for investing videos Follow me @calltoleap to start your journey toward financial freedom! #CarBudgeting #MoneyTips #FinancialFreedom #35PercentRule #InvestSmart

31.1k

2.34%

Want to be rich? Don’t do these 3 things 🚫 1. Don’t buy a luxury lifestyle if you can’t afford it. 2. Don’t drive a luxury car. A car is the number 1 wealth killer. 3. Don’t lend money or co-sign for friends and family. If you want to give them money, consider it a gift and don’t expect them to pay it back. What other tips would you add to this list? Let me know in the comments below! 👇 -Steve If you’re ready to start investing this year, don’t miss my next Beginner’s Investing Masterclass! Sign up now — link in bio! Follow @calltoleap Follow @calltoleap for investing videos Follow me @calltoleap to start your journey toward financial freedom! #MoneyTipsForTeens #FinancialFreedom #18AndSmart #BudgetBetter #CallToLeap

37.7k

2.86%

Are you 18 or about to turn 18? Then here are 3 things you need to know so you don’t end up living paycheck to paycheck like so many people in the U.S. Start strong now, and your future self will thank you. -Steve If you’re ready to start investing this year, don’t miss my next Beginner’s Investing Masterclass! Sign up now — link in bio! Follow @calltoleap Follow @calltoleap for investing videos Follow me @calltoleap to start your journey toward financial freedom! #MoneyTipsForTeens #FinancialFreedom #18AndSmart #BudgetBetter #CallToLeap

125.4k

3.06%

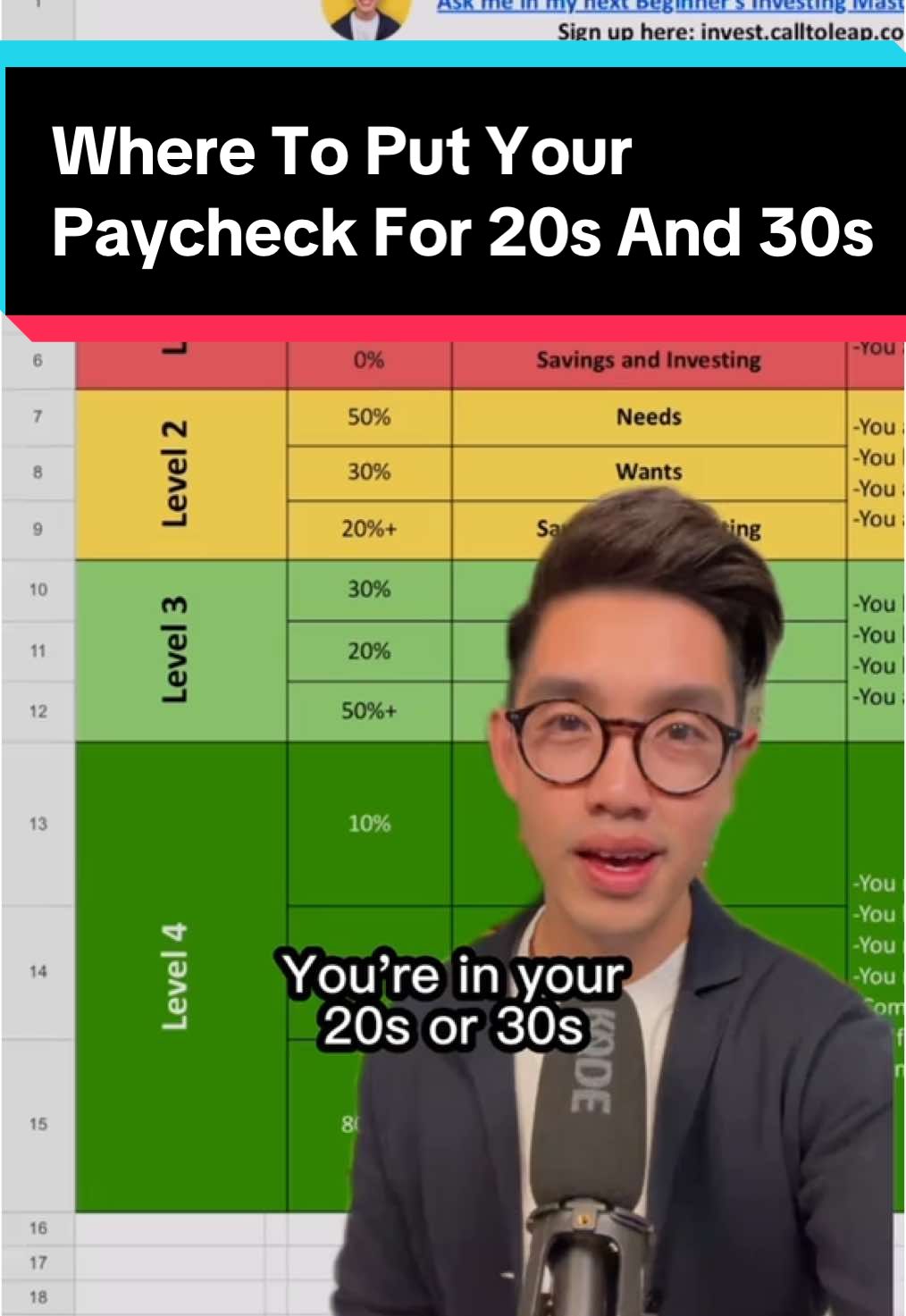

Are you in your 20s or 30s and still unsure how to split your paycheck? This quick 60-second video that breaks down 4 budgeting levels of people so you can see exactly where you stand—and how to level up. 👀 The budgeting sheet I use is 100% free and it's linked in my bio. Tag a friend and I’ll send it to both of you right now! 👇 - Steve If you’re ready to start investing this year, don’t miss my next Beginner’s Investing Masterclass! Sign up now — link in bio! Follow @calltoleap Follow @calltoleap for investing videos Follow me @calltoleap to start your journey toward financial freedom! #BudgetingTips #MoneyHabits #LevelUpYourFinances #CallToLeap #FinancialFreedom

18.3k

3.17%

Curious what I invested in my 1.3 million dollar account? I’ll share it all with you in this video! 🎥💰 I’ll also share more about how to get started with investing as a complete BEGINNER in my free investing class. Check below for the invite link or comment BIMC and I’ll send you the link right away! -Steve If you’re ready to start investing this year, don’t miss my next Beginner’s Investing Masterclass! Sign up now — link in bio! Follow @calltoleap Follow @calltoleap for investing videos Follow me @calltoleap to start your journey toward financial freedom! #InvestingJourney #MillionDollarAccount #FinancialFreedom #InvestSmart #BeginnerInvesting #Masterclass

55.2k

2.66%

#ShiptPartner : 🚗📦 All pet owners can agree that once their furbaby gets sick, it's a huge stress. When I didn't have it in me to go to the store last week, I turned to @Shipt where I could get all of my dogs new food delivered right to my door. Even better, with a Target Circle 360 membership, you can now shop on Shipt without any price markups across stores.

Offer valid for Target Circle 360 members only. Now through May 2026. Pricing is generally based on information from retailers, including alcohol pricing. "No Markups" means product prices are generally the same as in-store, except for alcohol. Alcohol prices, and prices on non-alcohol items where alcohol is predominantly sold, are generally not the same as in-store. Pricing and availability is subject to change without notice, delays, data limitations, adjustments, and/or errors. In-store deals may not apply.

6.9k

1.96%

Comment INVEST or tag your friend if you want to learn how to invest at my next Beginners Investing Master Class 🙂 This is exactly how I’d invest my first $10,000 💵 1. Avoid high-risk picks: No meme stocks, cryptocurrency, IPOs, or penny stocks. 2. Diversify: Invest in a fund that tracks the S&P 500. 3. Focus on growth: Add a technology growth ETF like QQQ. 4. Earn passive income: Include a high-dividend-paying ETF like SCHD. 💡 Tip: Before investing, make sure you have 3–6 months' worth of expenses saved in a high-yield savings account. -Steve If you’re ready to start investing this year, don’t miss my next Beginner’s Investing Masterclass! Sign up now — link in bio! Follow @calltoleap Follow @calltoleap for investing videos Follow me @calltoleap to start your journey toward financial freedom!

81.8k

3.27%

Ever wondered what income level you fall into? Here's a breakdown of the 5 income levels and their earnings according to the US Census Bureau. If you want to learn more about money start by reading my Financial Freedom Faster E-book and track everything using my sheet. Yes! this is all FREE on my bio or you can tag your friends in the comment and I’ll send it to both of you right now! - Steve If you’re ready to start investing this year, don’t miss my next Beginner’s Investing Masterclass! Sign up now — link in bio! Follow @calltoleap Follow @calltoleap for investing videos Follow me @calltoleap to start your journey toward financial freedom! #IncomeLevels #FinancialFreedom #MoneyManagement #InvestingForBeginners #USCensus

384.2k

0.92%

Still trying to figure out how to really save money? Let me show you exactly what I did back when I was saving on a teacher’s salary. - Steve If you’re ready to start investing this year, don’t miss my next Beginner’s Investing Masterclass! Sign up now — link in bio! Follow @calltoleap Follow @calltoleap for investing videos Follow me @calltoleap to start your journey toward financial freedom! #MoneySavingTips #TeacherBudget #CallToLeap #FinancialFreedomJourney #InvestSmart

55.6k

3.23%

10 years ago, I learned that I just need to follow these steps to REALLY save money when traveling.✈️ I’ll tell you exactly how in this video! - Steve If you’re ready to start investing this year, don’t miss my next Beginner’s Investing Masterclass! Sign up now — link in bio! Follow @calltoleap Follow @calltoleap for investing videos Follow me @calltoleap to start your journey toward financial freedom! #TravelHacks #SaveMoney #SmartSpending #InvestSmart #FinancialFreedom

24.8k

4.29%

Technology

Fastest Growing